AlphaProTrader E-mini Futures Day Trading

Trading group support and education, live market trading, and NinjaTrader add-in for a turnkey E-mini trading system.

E-mini Futures Trading Room & Turnkey Trading System

APT VIP trading group for E-mini futures. Traders help traders, with multiple moderators trading live to educate and mentor using turnkey workspaces and a live trading stream.

AlphaProTrader Club is a community for retirees and professionals focused on E-mini and micro indices futures day trading. Join our Discord group, trade on any platform, or use the NinjaTrader platform add-in. Get started with a 1-to-1 onboarding meeting, remote installation support, product tour, coaching, trade room access, and a 1-month APT system pass—get started the easy way!

Live streaming, video, chat, support, and voice commentary for E-mini indices, oil, and gold futures—Monday to Friday.

Trading Group

Discord group support, education, chat, live market streams, and trade-along chats.

E-mini Day Trader

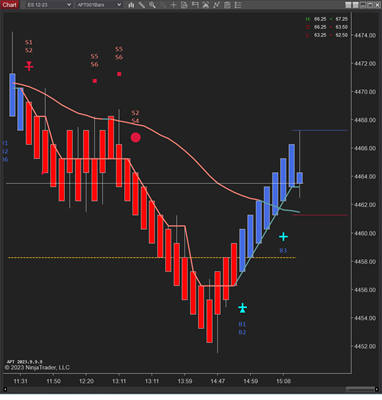

Proprietary NinjaTrader 8 platform plugin for day trading E-minis.

Hybrid Algo Trader

Choose your level of automation and interact in real time with the APT Algo day-trading system.

Who is APT suitable for?

- Ideal for retirees and professionals who can attend the live group sessions

- E-mini Futures Group: NYSE hours, Mon–Fri, 08:00–12:00 CT

- Live market trading commentary, charts, and mentoring

- Indicators, bars, and turnkey chart workspaces

- NinjaTrader Strategy Hybrid Automated Algo Trader

Get Started Trading with 1-to-1 White Glove Onboarding

All traders receive a 1-to-1 remote session to get started, including installation, access to the group, a demo and tour, and setup assistance to trade along with live market streaming and the Discord group trading room.

Get Started Promo: $147 USD

- 1-to-1 Remote Meeting

- Installation & Setup

- Trading Group Access

- 1-Month Room Pass

- 1-Month APT Trial

- Click here to Get Started

AlphaProTrader Flexible Pricing

APT subscriptions are flexible—cancel anytime or pause via direct access to your Stripe customer portal.

Choose between subscriptions and one-time purchases for trading software turnkey workspaces, trading group access, education, and support. Cancel anytime—no lock-in period.